The bullion counters traded higher in morning deals on Tuesday ahead of a crucial Brexit meeting, as uncertainty loomed over how Britain will leave the European Union.

gold futures exchange

Gold Report: Negatively Impacted by Positive Newsflow on the US-China talks

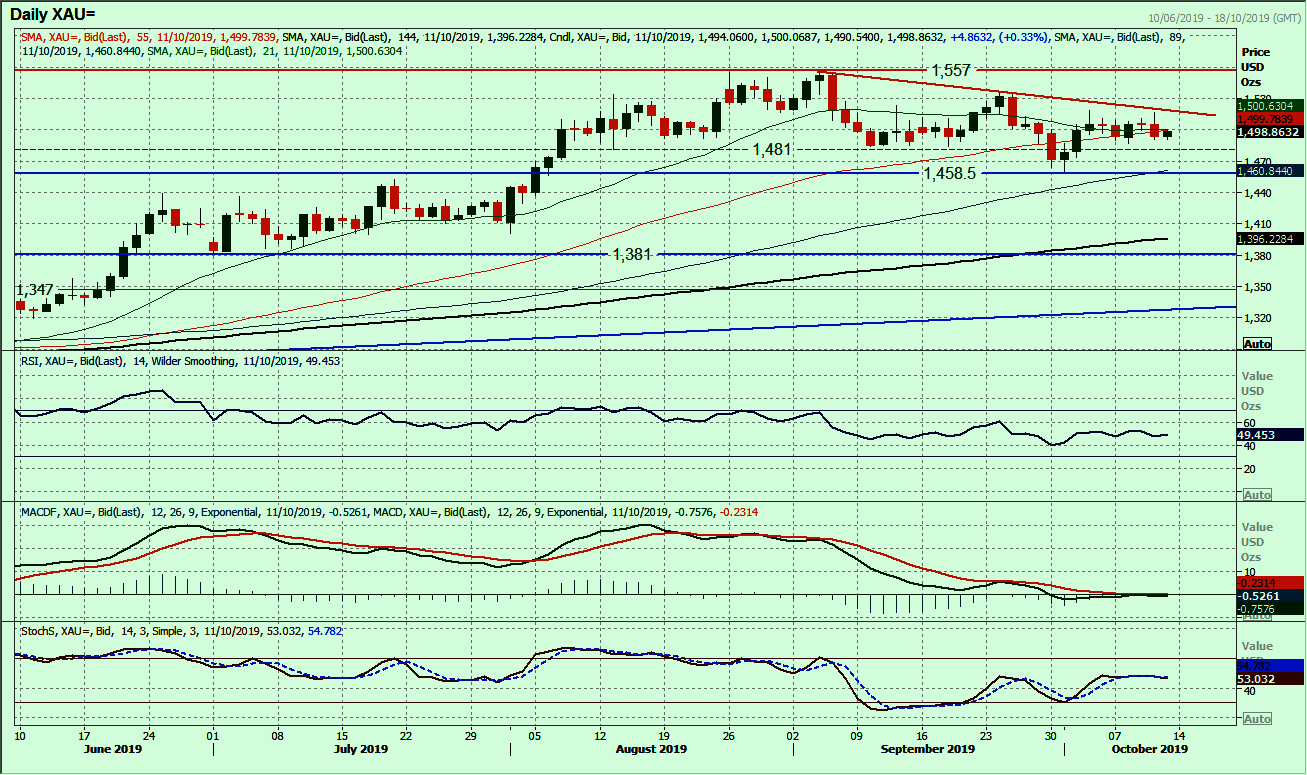

Gold Report : Gold is another safe haven that has been negatively impacted by positive newsflow on the US/China talks. The price reaction on major markets yesterday would suggest that despite a weakening dollar, gold is not an asset to be stuck in long should there be a positive outcome from these trade talks today. A bearish outside day candle has flipped the technical outlook towards a negative near term bias once more.

Gold Move Zig Zag – Non-Farm Payrolls @ 136K – Gold Silver Reports

Non-Farm Payrolls Data – The US economy gained 136,000 in jobs, within expectations. The report includes significant upward revisions to previous months. Wages are 0% monthly and 2.9% yearly – a disappointment.

Precious Metals Up: All eyes on the Fed and Nonfarm Payrolls – Gold Silver Reports

The focus is now on the US Dollar. Will it be able to hold up in worsening domestic economic conditions?

This week’s Nonfarm Payrolls will be the key following an eye-catching fall in the ISM Manufacturing which slipped deeper into contractionary levels in September. A strong Dollar is feeding through and hurting the US manufacturers, according to Donald Trump, “As I predicted, Jay Powell and the Federal Reserve have allowed the Dollar to get so strong, especially relative to ALL other currencies, that our manufacturers are being negatively affected.

Spot Gold Trade Frail Below $1500 Mark, Near By Monthly Lows

Spot Gold edged lower through the early European session on Monday and is currently placed at the lower end of its daily trading range, around the $1490 region.

Gold and Silver Ratio Travelled Between 83.87 and 84.66

The gold and silver ratio travelled between 83.87 and 84.66 with a bullish bias as gold surges on. However, Gold for December delivery on Comex dropped $9.60, or 0.6%, to settle at $1,506.20 an ounce.

Spot Gold Bearish Traders are likely to Aim Towards Testing the Target $1440 Level

Spot Gold Bearish traders are likely to aim towards testing the $1440 support area. Gold maintained its bid tone through the mid-European session on Wednesday and for now, seems to have snapped four consecutive days of losing streak.

Gold Spot If Close Below $1480 Sell MCX Gold Again 100–500 Lots – Neal Bhai Reports

Gold Spot If Close Below $1480 Sell MCX Gold Again 100–500 Lots – Neal Bhai Reports

News that the U.S. and China agreed to work toward a fresh round of trade talks next month provided a boost to the U.S. and global stock markets, and a stronger-than-expected private-sector employment data also helped to ease worries about a slowdown in the economy, damaging the metal’s haven appeal.

Gold Boom Higher on Lackluster Non-Farm Payrolls Data – Gold Silver Reports

The increase in new jobs for July was downwardly revised to 159,000 from 164,000 and June’s figure was cut to 178,000 from 193,000. Average hourly earnings was a bright spot, rising by 0.4% in August and 3.2% over the year, beating expectations. The market reacted to the jobs data with a sharp rally in gold and the US dollar weakening against its major counterparts.

MCX Gold Below 38844 Sell More Gold And Relaxxx

MCX Gold settled down 2.33% at 38894 dropped sharply posting their largest one-day dollar loss in almost three years to settle at a two-week low.