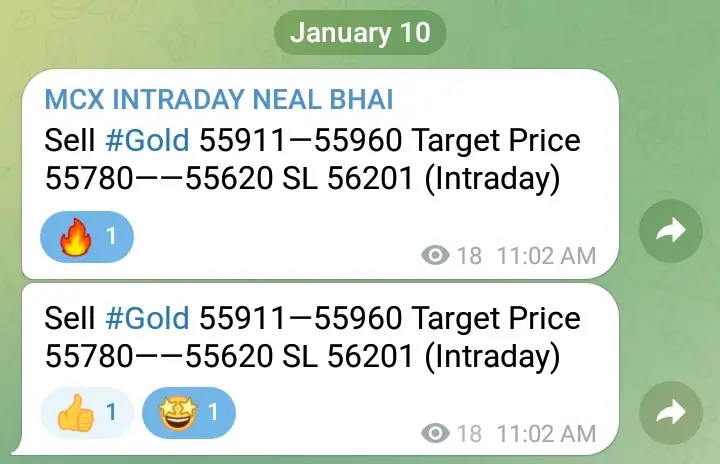

MCX Gold Tips For Today: Spot Gold price extends its consolidative price move for the second successive day on Tuesday and holds steady near an eight-month high touched the previous day. The gold is currently placed just below the $1,888 level as traders keenly await Federal Reserve (Fed) Chair Jerome Powell’s speech for a fresh impetus.

#GOLD LOW 55704 👈🏼👈🏼👈🏼

#GOLD LOW 55704 👈🏼👈🏼👈🏼

#GOLD LOW 55704 👈🏼👈🏼👈🏼

226 Point Done (1st Target Fully Done) 💰💰💰

Gold (Yellow Metal) Profit 45,200 in 2 Lots 🔥🔥🔥

सारे ट्रेड में आपको लोस ही हो रहा है??

तो ज्वाइन करिए आज ही हमारा ग्रुप फ्री में लगातार प्रॉफिट के लिए जल्दी करिए.

लिंक नीचे दिया गया है

EQUITY MARKET 👇👇👇

https://t.me/banknifty_nifty_NealBhai_Tips

MCX LINK 👇👇👇

https://t.me/Neal_Bhai_MCX_Tips

Technical Power of CFA’s

(CHARTERED FINANCE ANALYST)

“No Magic, No Miracle, Just Power of Level”

Neal Bhai Reports (NBR) By CFA’s Technical Team

Mobile No. 9582247600 & 9899900589

Softer risk tone lends support to safe-haven Gold price

Apart from this, the prevalent cautious mood could lend some support to the safe-haven Gold price and favours bullish traders. Despite China’s pivot away from its strict zero-COVID policy, worries that the massive flow of Chinese travellers may cause another surge in infections weigh on the risk sentiment. Furthermore, the protracted Russia-Ukraine war has been fueling concerns about a deeper global economic downturn and tempers investors’ appetite for riskier assets. This is evident from a softer tone around the equity markets and lends support to the gold.

- A softer risk tone lends some support as traders now keenly await Fed Chair Powell’s speech.

- Gold price holds steady near an eight-month high touched on Monday, lacks follow-through.

- Rebounding US Treasury bond yields revives the US Dollar demand and acts as a headwind.

The aforementioned fundamental backdrop suggests that the path of least resistance for the Gold price is to the upside and supports prospects for an extension of the recent appreciating move. That said, it will still be prudent to wait for a sustained move beyond the overnight swing high, around the $1,881 zone, before placing fresh bullish bets.