From South Africa’s ultradeep mine shafts to vaults underneath London, from metals traders in New York skyscrapers to mainstreet sellers of coins: the global gold market is being tested like neverbefore.

The cracks are starting to show.

Worldwide panic over the coronavirusoutbreak and a flood of stimulus by central banks has ignited demand for one of humanity’s oldestmethods of storing wealth. But even though there’s literally thousands of tons of gold bars sitting in vaults around the world, it’s suddenly much harder to get metal when and where it’s needed.

“Since last week, face masks, hand sanitizers, toiletrolls and bullion have something new in common – they run out when everyone tries to buy them,” said Vincent Tie, sales manager at Silver Bullion PteLtd in Singapore.”

Read More : Gold Silver Rocket – My Paid Client’s Mint Money – Jo Dar Gaya Samjho Mar Gaya

Here are four key ways in which the gold market is being upended by the coronavirus crisis:

1. Precious Metal

Gold’s age-old appeal as a store of value in a time of crisis has sent demand for metal surging. Even if companies, financialinstitutions and nation states crumble, the virtually indestructible metal offers investors a way to convert their assets into high-value bars that can be stashed in a vault or under a mattress. For institutionalinvestors like fund managers, gold offers a way to shieldagainst losses elsewhere in their portfolios, while governments have relied on the metal as a universal currency that can provide a buffer for nationalreserves.

2. Not So Refined

Much of the world’s gold is stored in vaults in London, Switzerland and New York. The largest single depository is the NewYork Fed, which holds 497,000 bars stacked high on the Manhattan bedrock. In London, the Bank of England in the City of London holds a further 400,000 bars, whileother vaults are operated by banks and logistics companies.

The gold market links these hubs with mines spread around the globe and refineries that buy up gold ore from miners and scrap bars and jewellery and produce bars and coins of various sizes – whatever is in highestdemand. This week, three of the largest refiners, located in the canton of Ticino in Switzerland, were forced to close after authorities ordered a lockdown.

3. Plane Talking

It’s getting harder to transport gold because it typically flies around the world on ordinary commercial flights, which are being canceled by the thousands.

And while some flights are still moving, there’s a limit to how muchgold can go on each airplane. It’s not weight, but value: it’s not possible to get insurance for more than a certain amount on any oneplane. But it’s not unheard of for nations to send militaryplanes to ship their gold around the world, complete with armed escorts.

In one sign of how things have slowed down, shipping Russian goldoverseas can now take about a week instead of a day, said Alexey Zaytsev, head of commodities & funding products at Otkritiebank.

4. Spreading Out

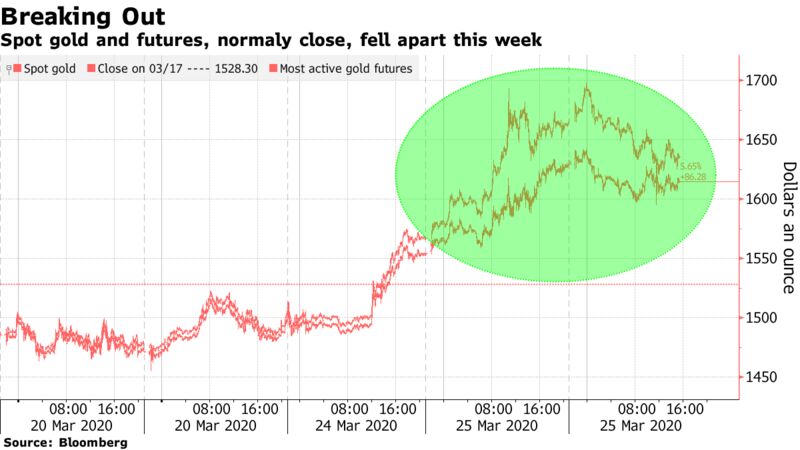

All these factors have combined to create a historic squeeze in the New York goldfutures. Typically investors-buy futures to get exposure to gold prices without having to worry about the day-to-day inconveniences of actually owning metal, while banks use futures to hedge their physical metal exposure.

However, if investors hold their futures contract to expiry, they will receive physical metal in a specific form: one 100-ounce bar or three kilobars. Ordinarily, if the price of the New York gold futures rises too far above goldprices elsewhere in the world, banks simply buy kilo-bars elsewhere in the world and fly them to New York. But the disruption of global supply chains has thrown that process into doubt.

The result has been a sharp spike in futuresprices, making metal in New York much more expensive than gold for immediatedelivery in London. The surging difference – known as a spread – has rattled even veteran traders.

5. Tools Down

Even mines are being disrupted, with an industrywide shut down in South Africa – unprecedented in its 150-year mining history – the most dramatic example. Operations are also being stopped or curtailed elsewhere, from Argentina to Canada.

![Spot Gold Short-Term Technical Forecast [11 March 2025]](https://www.goldsilverreports.com/wp-content/uploads/2019/01/Gold-bar-5945sdf54@Neal-Bhai-Reports-nbr.jpg)