Spot gold prices fell 1% to $1,851.50 per ounce by 10:10 a.m. EST (1510 GMT), retreating from a two-week high hit on Thursday. The metal was up 1.4% so far this week.

best gold investment

Gold Edged up, Bullion Has Been Pressured lately By Stronger Dollar

Gold edged up, recovering from an almost seven-week low, amid caution in markets as investors assessed the outlook for the dollar and the timeline for a U.S. stimulus package.

Broad Risk-on Sentiment Weighed on the US Dollar, Buying Precious Metal Prices

Precious Metal Prices : Gold prices rallied as much as 1% on Monday after President Trump signed a $2.3 trillion bill that contains $900 billion in pandemic relief aid and $1.4 trillion in government spending to fund federal agencies.

Gold Price Forecast 2021 : Gold 1Q Outlook Bullish Headed, Target $1965

What started with a bang is now ending with a whimper. After a meteoric rise in gold prices through the first three quarters of 2020 (gaining +24.3% from January 1 through September 30), gold prices cooled off in 4Q’20, having lost around -1% at the time this forecast was written in December 2020.

Spot gold Prices Have Been on The Front Foot in Recent Trade

Spot gold prices have been on the front foot in recent trade, with a boost coming at 13:30GMT in the form of slightly softer than expected US Consumer Price Inflation numbers. Spot gold popped above the $1840 level and Wednesday Asia session highs at $1842, but has so far failed to break above $1850. As things stand, the precious metal trades with gains of close to $8 or 0.5% on the day.

Gold Extends Drop on Vaccine, Signs of Improving U.S. Economy

Gold fell to a four-month low as growing optimism over a coronavirus vaccine and signs of a increasing momentum in U.S. economic growth stifled demand for the metal as a haven.

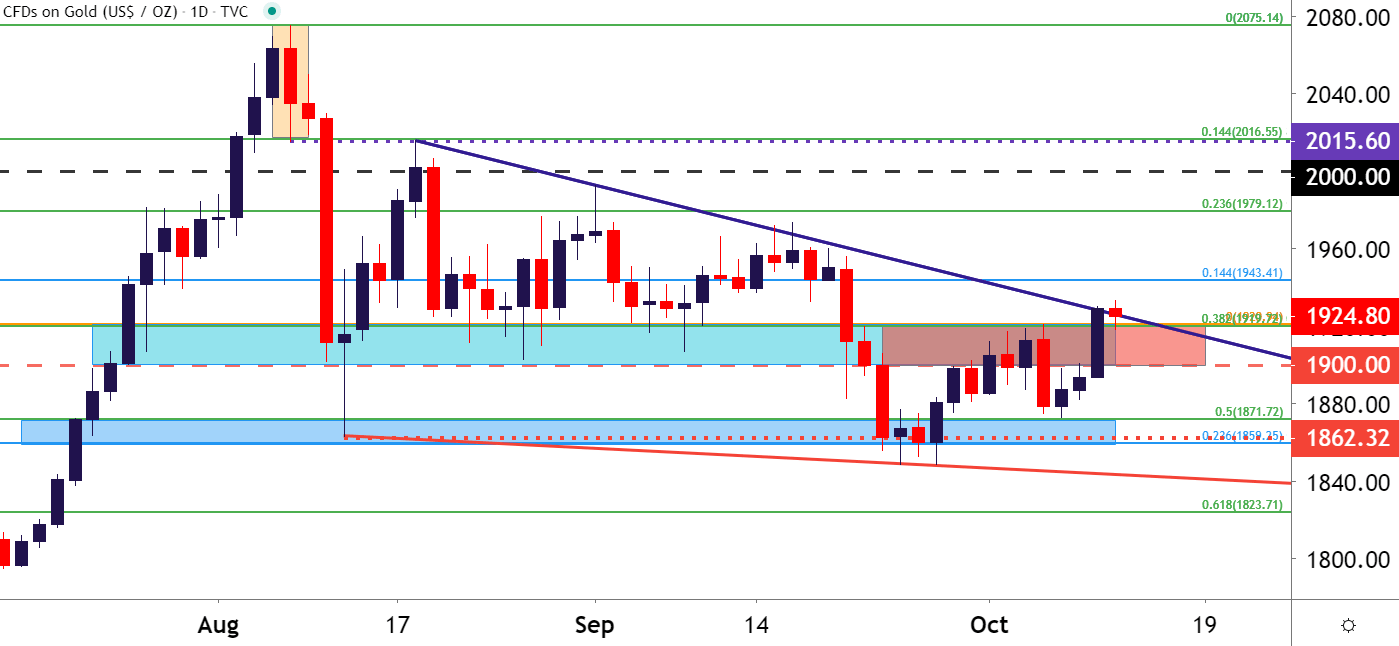

GOLD TECHNICAL ANALYSIS : Gold Support Zone $1840—$1838, Below Target $1810 ——$1780 – Neal Bhai Reports

GOLD TECHNICAL ANALYSIS : Gold prices are under down trend now-familiar range support in the 1840-$1838 Level. Breaking below this barrier on a daily closing basis looks likely to open the door for target $1810/oz figure to challenge former resistance in the $1780 zone. Alternatively, an upswing past the $1910 inflection region probably targets the swing top @ $1958.

GOLD TECHNICAL ANALYSIS TODAY – 05 NOV 2020 – Neal Bhai

GOLD TECHNICAL ANALYSIS: From a technical standpoint, the gold outlook remains biased to the downside. Falling resistance from August is keeping prices under pressure.

For Nine years the $1,920 level loomed large for Gold prices, As this was the prior All-Time-High set in 2011

It’s now been a couple of months that the bullish trend in Gold has been on pause; and this comes after an aggressive topside trend had taken-over this summer. After digesting over a two-month pattern from mid-April into mid-June, bulls took over to build a rally that drove for much of the next two months.

Gold prices gain as focus returns to pandemic, U.S. election

Gold prices firmed on Wednesday as uncertainties over a global economic recovery and the U.S. presidential election prompted investors to exploit a sharp pullback in the previous session to buy bullion.