MCX Gold Price Target: Gold price Friday settled up by 0.38% at 47353 gaining in strength thanks to another drop in bond yields and a weaker dollar.

The dollar lost ground against most of its rivals and yields on long term U.S. Treasury Notes hovered around one-month lows, weighed down by dovish comments from Fed officials.

Federal Reserve Chairman Jerome Powell reiterated his dovish stance on monetary policy and emphasized that any increase in inflation should be transitory. He also said the central bank will reduce its bond purchases before it commits to an interest rate increase.

Elevated domestic prices and renewed coronavirus restrictions due to a surge in infections dulled physical gold purchases in India, while China stepped up bullion imports as demand gradually rebooted.

MCX Gold Price Target

Dealers were charging a premium of up to $4 an ounce this week over official domestic prices, inclusive of 10.75% import and 3% sales levies, up from the last week’s $3.

China has given domestic and international banks permission to import large amounts of gold into the country, potentially helping to support global gold prices after months of declines.

Which country gold is best 2020?

- China is the world’s biggest gold consumer, gobbling up hundreds of tonnes of the precious metal worth tens of billions of dollars each year, but its imports plunged as the coronavirus spread and local demand dried up.

The gold pair spent the first half of the day in a relatively tight range below $1,750 but rose sharply on Thursday amid a steep decline witnessed in the US Treasury bond yields. Gold managed to preserve its bullish momentum ahead of the weekend and advanced to its highest level since late February at $1,783 on Friday. On a weekly basis, the precious metal posted its largest percentage gain since December, nearly 2%.

What happened last week

In the absence of significant macroeconomic data releases at the start of the week, the decent demand seen at the 10-year US Treasury note auction did not help yields to gain traction and made it difficult for the greenback to find demand.

On Tuesday, the data published by the US Bureau of Labor Statistics revealed that annual inflation, as measured by the Core Consumer Price Index (CPI), edged higher to 1.6% in March from 1.3%. Although this reading surpassed the market expectation of 1.5%, it failed to provide a boost to yields as it confirmed that price pressures were not yet as strong as initially feared. The benchmark 10-year US T-bond yield lost more than 3% on a daily basis and allowed gold to remain in the upper half of its range.

MCX Gold Price Target

While speaking at a virtual event organized by the Economic Club of Washington on Wednesday, FOMC Chairman Jerome Powell reiterated that it was really unlikely for the Fed to start raising rates before the end of 2022. “Low inflation, deflation reduce the ability of the central bank to fight downturns,” Powell added. “We want to overshoot inflation moderately after we’ve been below 2%.”

On Thursday, the US Census Bureau announced that Retail Sales in March surged by 9.8% following February’s 2.7% decline. Furthermore, the weekly Initial Jobless Claims fell to the lowest level in a year at 576,000. These upbeat figures provided a boost to market sentiment and the S&P 500 Index climbed to a fresh record high. Consequently, the USD continued to face strong selling pressure and the 10-year US T-bond yield slumped to its lowest level in more than a month. In turn, gold gained more than 1.5% on the day.

The last data of the week from the US showed that the University of Michigan’s Consumer Sentiment Index rose modestly to 86.5 in April from 84.9. Nevertheless, the USD selloff remained intact and gold extended its rally beyond $1,780.

Gold Next week Target Price

There will not be any significant macroeconomic data releases at the start of the week. On Tuesday, the labour market report from the UK will be looked upon for fresh catalysts. Although this event is unlikely to have a direct impact on gold’s valuation, a sharp movement in the GBP/USD pair could drive the USD’s overall market performance.

On Thursday, the European Central Bank will announce its Interest Rate Decision and release the Monetary Policy Statement. Investors are not expecting any changes to policy but the bank could provide forward guidance with regards to changes in asset purchases. A dovish policy outlook is likely to weigh on the shared currency and ramp up the demand for the USD.

Finally, the IHS Markit will release the preliminary April Manufacturing and Services PMI reports for the euro area, Germany, the UK and the US. Market participants are likely to ignore the headline figure and focus on the underlying details that can reveal fresh insights with respect to input price constraints. Meanwhile, investors will continue to keep a close eye on yields.

Disclaimer: The views and investment tips expressed by experts on GoldSilverReports.com are their own and not those of the website or its management. GoldSilverReports.com advises users to check with certified experts before taking any investment decisions.

Gold futures on MCX were up 0.11 per cent or Rs 52 at Rs 47,584 per 10 grams. Silver futures dropped by 0.01 per cent or Rs 9 to Rs 68,665 per kg.

In the spot market, the price of gold was marginally lower by Rs 24 to Rs 47,273 per 10 gram in the national capital on Friday. Silver also declined Rs 909 to Rs 68,062 per kg.

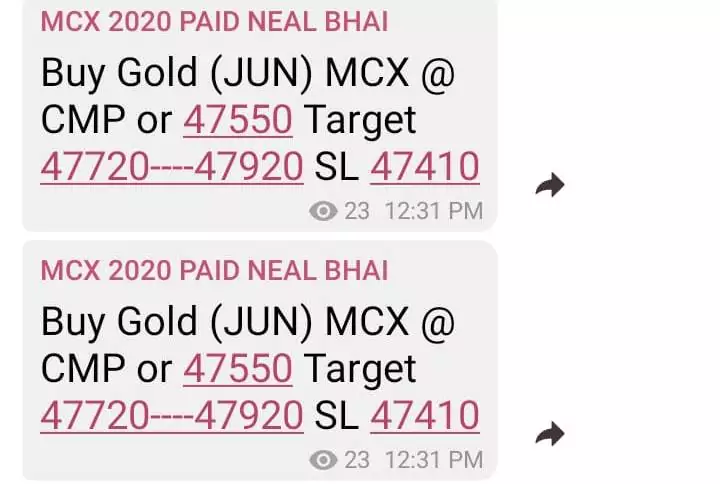

“As per our last week’s view, MCX Gold prices traded in a positive zone for the whole week. Prices are holding above the 100 EMA level on the daily chart which is now placed near Rs 47,200 level. Any dip in the prices can be viewed as a buying opportunity. Buy MCX gold (Jun) in the range of Rs 47,700 to Rs 47,900 for the target of Rs 49,000/49,500 with a stop loss below Rs 47,000,” said NS Ramaswamy, Head of Commodities, Ventura Securities.