Spot gold price lost some additional ground during the mid-European session and dropped to 2-day lows, aroundthe $1845 region in the last hour.

The yellow metal witnessed some selling on the last trading day of the week and moved further away from 2week tops, around the $1875 region set in the previoussession. The pullback could be solely attributed to a modestpickup in the US dollar, which tends to undermine demand for the dollar-denominated commodity.

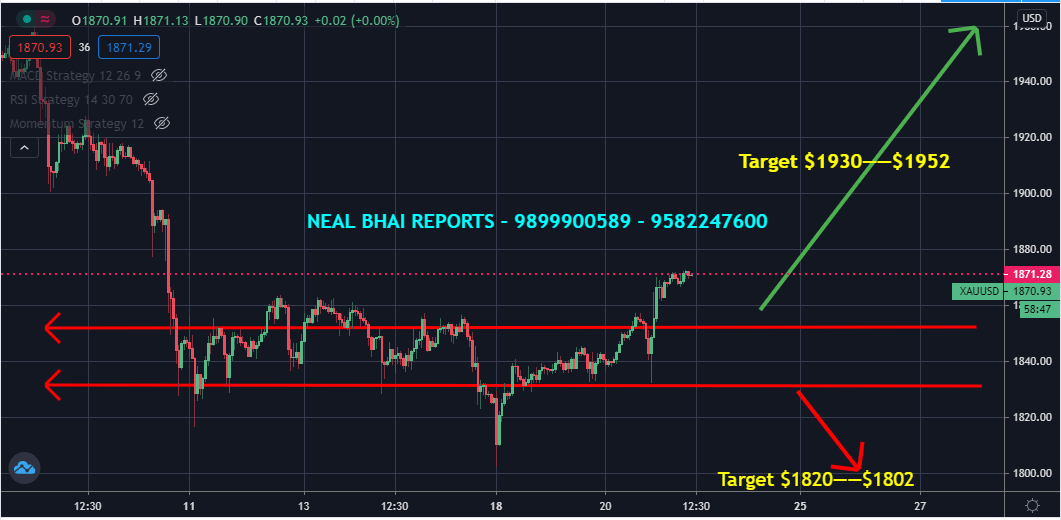

The gold price, for now, seems to have stalled this week’s solid bounce from the vicinity of the $1800 mark, or 8week lows touched on Monday. That said, a slight deterioration in the global risk sentiment – as depicted by a turnaround in the equity markets – might extend some support to the safe-haven commodity. Gold Spot Open Long positions Target $1930—$1952

The imposition of a partial lockdown in Beijing resurfaced concerns about the potential economic fallout from the coronavirus pandemic and weighed on investorssentiment. The flight to safety was evident from sliding US Treasury bond yields, which could further help limit the downside for the nonyielding yellow metal.

This, in turn, warrants some caution for bearish traders and makes it prudent to wait for some strong follow-through selling before positioning for any further nearterm depreciating move. Nevertheless, the gold still seems poised to end the week with gains of around 1.2% and snap two consecutive weeks of the losing streak.

Market participants now look forward to the release of the flash US PMI prints for a fresh impetus. Apart from this, developments surrounding the coronavirus saga will influence the broader market risk sentiment and play a key role in influencing the gold.