MCX Copper Target For Today: MCX Copper price yesterday settled by 0.83% at 706.35 as strong Chinese inflation data raised fears that the world’s biggest metals consumer will tighten monetary policy, though expected supply tightness kept prices on course for a weekly gain.

Copper inventories in warehouses monitored by the Shanghai Futures Exchange fell 2.1% from a week earlier, the exchange said.

CME raises comex copper futures (Hg) maintenance margins by 10.9% to $6,100 per contract from $5,500 for May. Treatment charges to turn copper concentrate into metal have crashed because of disruptions to mine supply globally.

What is today’s copper price?

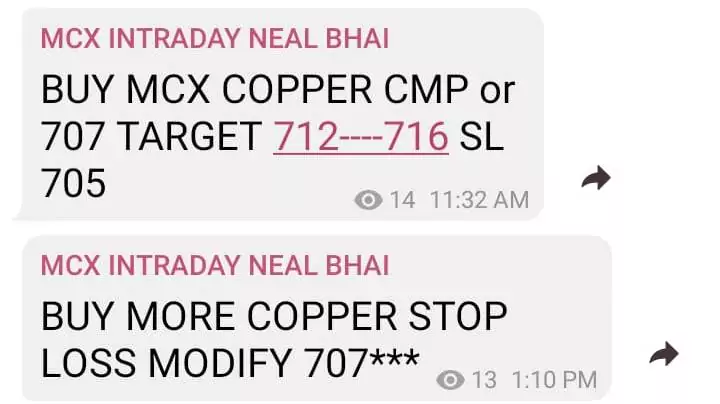

Intraday Copper Commodity Tips Chart & MCX Copper Target for Today

- Copper target and trading zone for today is 702—716

- MCX Copper prices gained as support seen after China’s exports grew at a robust pace in March in yet another boost to the nation’s economic recovery as global demand picks up.

- Inventories in LME-approved warehouses hit 165,625 tonnes, their highest since Nov. 11.

- While stockpiles in warehouses tracked by ShFE have been hovering around their 11-month high.

Smelters have had to accept lower treatment charges to ensure they have enough feedstock to keep their operations going. Copper stocks at 157,075 tonnes in LME registered warehouse have more than doubled since early March.

However, cancelled warrants metal earmarked for delivery at 36% and large holdings of copper warrants are fuelling worry about availability on the LME market, which has created a premium for the cash over the three-month contract.

U.S. President Joe Biden is expected to meet with lawmakers on his proposed infrastructure bill, which is expected to give a boost to demand for industrial metals, in the coming weeks.

Intraday Copper Commodity Tips Chart

Copper consolidation is seen as a healthy development in the intact core bull trend. In the end, strategists at Credit Suisse expect the metal to reach the $10190 key high of 2011.

Copper consolidation is seen as temporary

“Copper (LME) remains in its range but this is seen as a healthy and overdue phase following the impressive rally of the past year.”

“Support for a pullback is seen at the 63-day average, currently at $8594. Below can see a deeper pullback to $8570, with our bias remaining for this to prove a solid floor, and with next support then seen at $8238, the January 2021 high.”

“Post the consolidation, we look for a resumption of the uptrend back to and then above the current cycle high at $9617. We would then see resistance next at the psychological $10000 resistance level and eventually the key high of 2011 at $10190.” (With Agency Inputs)

MCX Copper Target For Today: MCX Copper price yesterday settled by 0.83% at 706.35 as strong Chinese inflation data raised fears that the world’s biggest metals consumer will tighten monetary policy, though expected supply tightness kept prices on course for a weekly gain.

MCX Copper Tips for Today: Sell Copper Call Hit 692.70 To 689 | Neal Bhai Reports (Best MCX Tips Provider) – 9899900589 & 9582247600

MCX Nickel Tips for Today: Sell Nickel Call Hit 1262 To 1250.90 | Neal Bhai Reports (Best MCX Tips Provider) – 9899900589 & 9582247600 Will copper prices go up in 2021? Q2 Top Trading Opportunities Nickel MCX Tips Today : All Target Price Hit Low 1184.30 Copper MCX Tips Today : All Target Price Hit …

Will copper prices go up in 2021? Copper Prices has witnessed phenomenal price appreciation since March 2020 when the pandemic surged, resulting in worldwide lockdowns. The metal has been supported by unprecedented monetary policy, ultra-low interest rates and more importantly, low or negative real yields.