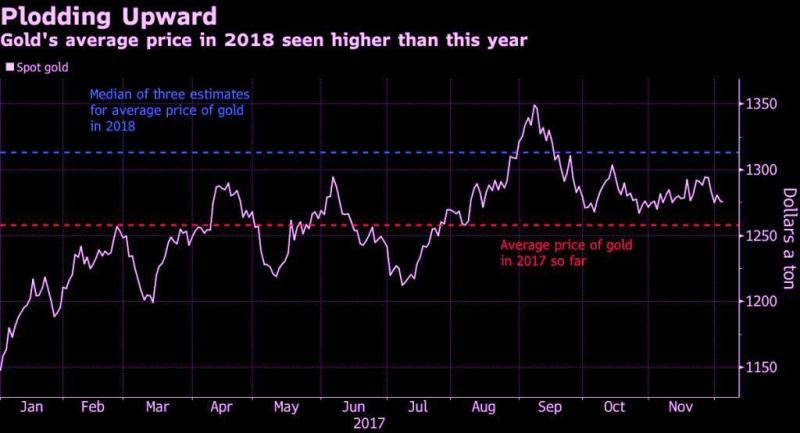

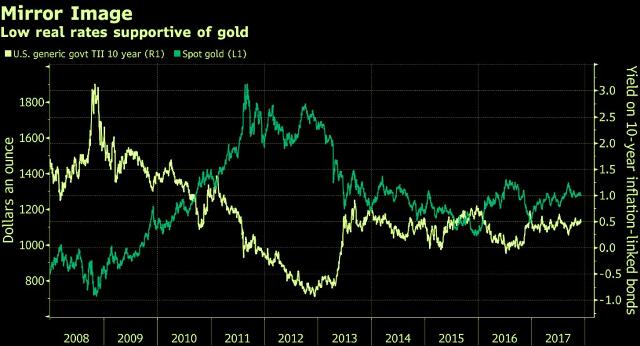

Gold Silver Reports – Don’t Expect Gold to Go Wild Next Year – Even as the Federal Reserve tightens monetary policy and the European Central Bank tapers bond purchases, gold is set to rise marginally as real interest rates stay low and the dollar weakens, according to Bart Melek, global head of commodity strategy at TD Securities Inc. in Toronto. He sees bullion averaging $1,313 an ounce in 2018, about 4 percent more than the mean so far this year.

“We don’t expect a big shock from the Fed in terms of rates,” Melek said in a phone interview last week. “Real rates continue to be quite low by historical standards. That represents a fairly limited rise in the opportunity costs of holding zero-yielding assets like gold. The yield curve is going to be fairly flat as well and that implies a robust precious metals market.”

“You’ve seen fear-based investors pull away, but you’re seeing a new generation of new types of investors” who are interested in gold because equities are at records and bond prices are high, and both are vulnerable for a correction, Christian said. Bullion holdings in exchange-traded funds are the biggest since 2013.

Melek, Steel and Christian are among speakers at a precious metals conference in Shanghai this week. Bullion traded at $1,266.18 on Wednesday.

Read More: Gold Spot Support Level $1247——$1250

Others are less optimistic. Citigroup Inc. is a little bearish in the second half, citing a slightly more hawkish Fed, optimism for tax cuts and sluggish Asian jewelry demand. Strong global economic projections for 2018 in developed and emerging markets should push gold down, said the bank, which predicts an average of $1,270 on Comex. ABN Amro Bank NV sees $1,250 by end-2018.

The outlook for the economy isn’t as upbeat as it seems, said CPM’s Christian. “What we’re looking at is an economic environment that is perhaps at or close to its peak and that we’ll probably see an incremental decline in growth rates in economic performances in 2018 and 2019, and you might actually see a short, shallow recession in the U.S. in that time frame,” he said.

U.S. tax reforms could support precious metals, TD Securities’ Melek said, as the legislation is set to add more than $1.4 trillion to the federal deficit over a decade. “If we see the debt-to-GDP ratio of the U.S. rise, that tends to be an accretive element for the gold and silver market broadly,” said Melek, who sees silver averaging $18.88 an ounce next year, up from $17.14 this year. – Neal Bhai Reports