Gold price headed for its worst month since late 2016 as a stronger dollar and expectations for improving economies diminish demand for the haven asset.

Dollar Spot Index was on course for a second week of gains. Meanwhile, a report Friday showed U.S. personal incomes soared in January as pandemic-relief checks helped to re-charge the economy with the strongest spending advance in seven months.

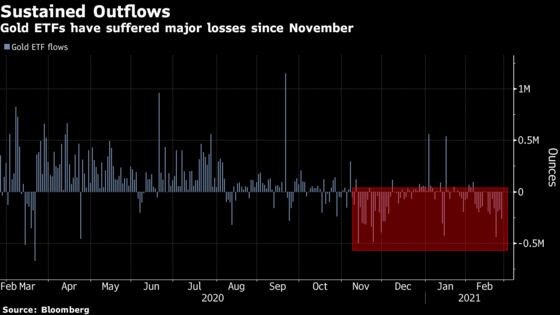

Bullion has fallen more than 8% this year as traders focus on a recovery from the Covid-19 pandemic and higher Treasury yields, which make the metal less competitive because it doesn’t offer interest. That has caused holdings in bullion-backed exchange-traded funds to fall to lowest since July.

Gold “is having a rough 2021 and the only thing that can right the ship is if central banks thwart the trajectory of bond yields,” said Edward Moya, a senior market analyst at Oanda Corp. “The Fed will have plenty of opportunities to stem surging Treasury yields, but for now it seems they can be a little more patient.”

Federal Reserve Chairman Jerome Powell this week assured investors that the central bank is in no rush to pull back stimulus, boosting demand for many raw materials while further reducing the appeal of gold as a haven asset. Powell called the recent run-up in bond yields “a statement of confidence” in the economic outlook.

Bullion declined further on Friday as traders exited positions, with U.S. equities trading mixed and global bond rout easing.

- In a Flash, U.S. Yields Hit 1.6%, Wreaking Havoc Across Markets

- Powell Is Patient But Markets Aren’t, Challenging New Fed Policy

- Copper Crunch Set to Ease With More Supply Heading to China

- Copper’s Spike Stirs Alarm Over Another Rush to Find Substitutes

- Gold ETF’s Woes Show Big Money May Leave Retail Behind: Chart

“Gold got hit aggressively just after the cash equities open today,” said Tai Wong, head of metals derivatives trading at BMO Capital Markets, noting that investors sold their holdings after the metal failed to maintain the key levels of $1,780 to $1,790 an ounce in overnight trading.

Spot gold dropped 2.4% to $1,728.92 an ounce at 3:22 p.m. in New York, after slumping to the lowest since June earlier. It’s down more than 6% this month, on pace for its biggest loss since November 2016. Futures for April delivery on the Comex fell 2.6% to settle at $1,728.80 an ounce.

Silver price and palladium declined more than 3% on Friday, while platinum was down more than 2%. Dollar Spot Index rose 0.6%.

Natixis’ Bernard Dahdah said he wouldn’t expect the same “collapse” in gold seen in 2011, “but clearly there will be some pressure on prices as economies in the West open up.”

He sees gold price around $1,700 in the longer term given the abundance of liquidity in financial markets. Bullion may also face downward pressure from stock market selloffs as some investors look for cash to cover margin calls, he said.

Source : Bloombergquint