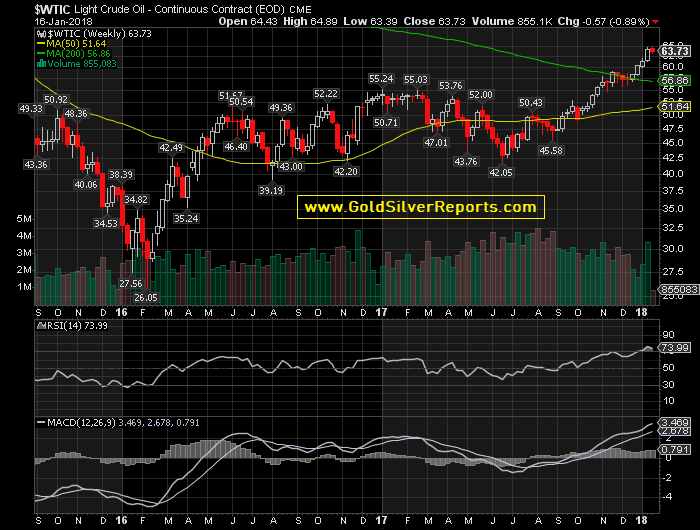

Gold Silver Reports – U.S Crude Oil Under Short Term Challenges — Short-term speculators may suspect downward conditions will prevail in the coming days after the dramatic rise upwards made by the commodity over the past few weeks.

Skeptical Regarding a Further Climb

U.S Crude Oil was pushed back on Tuesday. And while one day of selling does not constitute a dramatic shift in sentiment, traders may be growing skeptical about the commodity’s ability to climb further in the near term.

Crude Oil is near 63.40 U.S Dollars a barrel after yesterday’s headwinds. And there is important support around 63.00 Dollars.

Speculative Selling a Possibility

If U.S Crude Oil sees speculative selling increase recent gains made the past few weeks will face important tests.

While global economic data has certainly shown significant results, the supply of Crude Oil remains abundant.

Dramatic Trend Challenged

U.S Crude Oil has seen a dramatic upward trend the past several months, but if resistance around 64.50 Dollars a barrel holds the commodity may find speculative forces betting against it and profit taking grow.

Read More: Crude Oil Price Update – Market Set-up for Near-erm Pullback into $60.44

Although Crude Oil may have sunnier economic prospects mid-term, the commodity could find a challenging trading environment in the days to come.

In the short term, we believe U.S Crude Oil may be negative. In the mid-term and long-term, we are unbiased. – Neal Bhai Reports