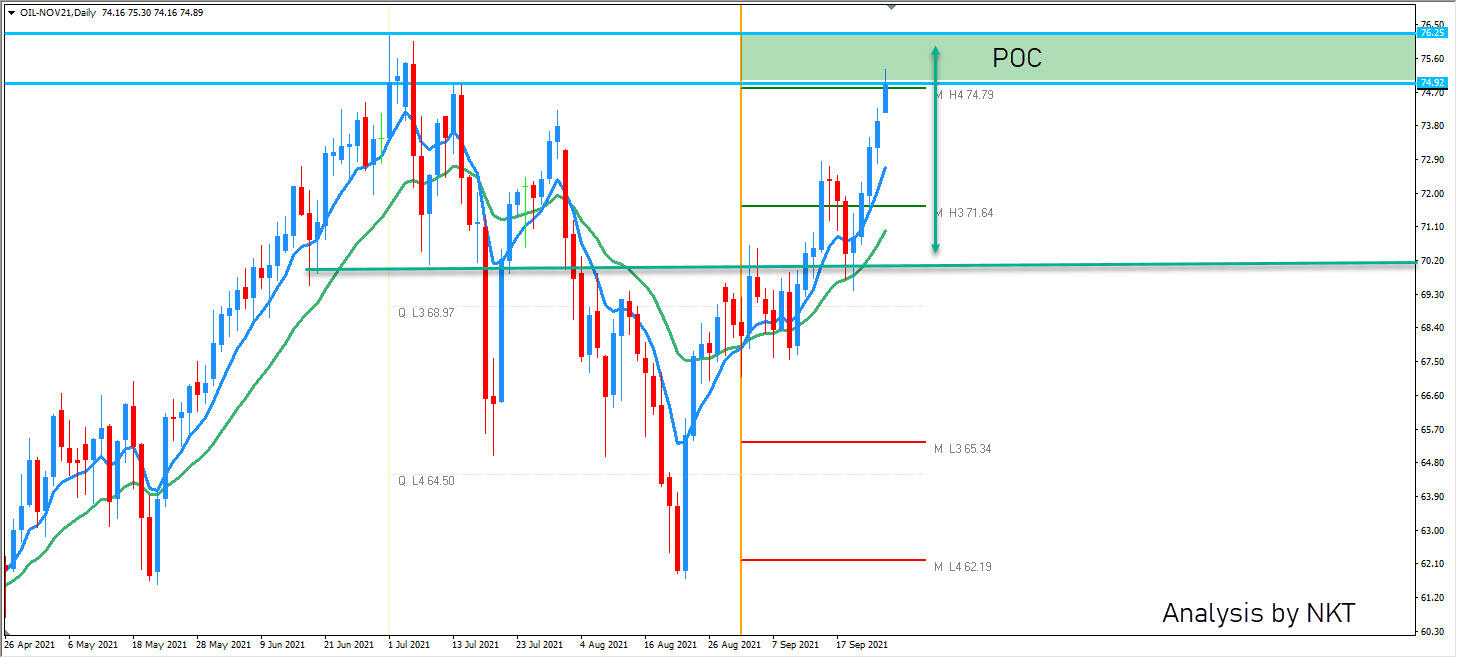

Crude Oil MCX Tips Today: Oil is in uptrend but it’s getting close to historical resistance. Daily (D1) pattern configuration is a signal for a short trade.

At this point we can clearly see the resistance. It’s highlighted in green. If we saw the market moving down that would be considered a pullback. I am aiming for a short trade on a bearish candlestick pattern configuration. Watch for it on a daily TF and look for 71.60 and 70.20 as the targets.

सोशल मीडिया अपडेट्स के लिए हमें Facebook ( https://www.facebook.com/goldsilverreports/ ) और Twitter ( https://twitter.com/goldsilverrepor ) पर फॉलो करें।

हमारी फ्री सर्विस और लोगो की paid सर्विस से कई गुना अच्छी है।

आपको हर दिन दिए जाएंगे 3 से 5 कॉल बिलकुल फ्री

हर CALL में PROFIT दिये जायेंगे

तो जल्दी से MCX CHANNEL को JOIN कर लो (NEAL BHAI REPORTS)

JOIN US CLICK HERE

High crude oil prices will lead to higher inflation and also worsen India’s current account deficit

The USDINR pair made a flat opening at 73.68 levels and traded in the range of 73.61-73.84 with an upside bias. The pair finally closed at its day’s high of 73.84 levels. The RBI set the reference rate at 73.6567.

The Indian rupee was down against the dollar today because Brent crude oil November futures rose beyond the $79-a-barrel-mark, dampening investors’ sentiment for the Indian rupee.

Brent crude oil prices moved near to the three-year high due to global supply disruptions, which have forced energy companies to pull large amounts of crude oil out of inventories. High crude oil prices will lead to higher inflation and also worsen India’s current account deficit by increasing the import bill and, hence, weigh on the Indian rupee.

There was a sharp rise in the yield on the 10-year benchmark US Treasury note after the US Federal Reserve last week stated that it would start tapering its massive $120 bln bond purchases by the end of this year which also weighed on the sentiment for the rupee.

Investors now await a series of speeches from US Fed policymakers this week for cues on the central bank’s plan on hiking interest rates. Fed Chair Jerome Powell will also testify this week before Congress on the Fed’s policy response to the COVID pandemic.

On an annualized basis, a premium on the one-year, exact period dollar/rupee contract rose to 4.38% as against 4.37% of the previous close. The 10-year G-Sec benchmark 06.10 GS 2031 closed the day 3 bps higher at 6.210% levels.