Copper Technical Analysis May Point to Short-Term Correction : Copper has been the stand out commodity (metals) in terms of price action these past few weeks with multi-year highs being breached.

Copper Technical Analysis & Outlook

Copper (Red Metal) is a unique metal in that it has a vast range of uses across different industries that set it apart from more limited-use metals. This broad use allows for copper to act as an inflation hedge due to its proxy for economic growth. With COVID-19 vaccine rollouts taking place across the world coupled with a low interest rate environment, copper has been surging in line with an expectant economic recovery.

Historically, the inflation to copper price correlation has been largely positive (see chart below) as both variables are influenced by similar factors. Yesterday, Fed Chairman Jerome Powell highlighted inflation as being “soft” as inflation data currently sits well below their goals although the labour market is showing promise. To combat this issue, Powell continued to stress the Fed’s reluctance to tighten monetary policy which could provide additional support for medium-term copper prices.

LIMITED COPPER SUPPLY WHILE DEMAND INCREASES ACROSS INDUSTIRES

Copper supply has been under strain as demand rises which has contributed to the recent price swell. Demand is expected to increase as alternative ‘green’ avenues and industries expand. Main drivers include Electric Vehicles (EV’s), energy storage and 5G networks. As these components grow as an influence on copper, it could be forecasted that this would lead to higher copper prices over time.

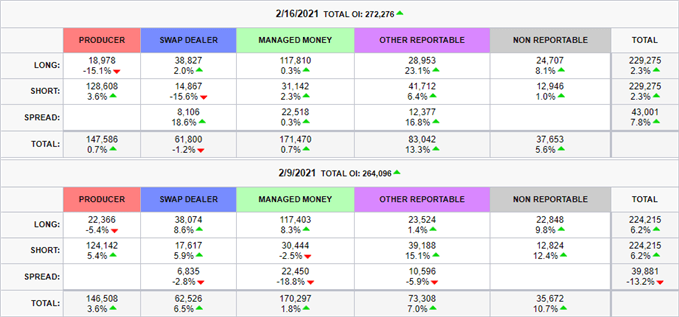

COPPER FUTURES COMMITMENT OF TRADERS (COT) REPORT SUMMARY

The copper COT report summary shows that long positioning may be dissipating as market participants become wary of the sharp rise in copper prices. While positioning remains largely net-long, the percentage change from the previous report shows a decrease in additional positions. This could lead to a correction or consolidation in copper prices (short-term) which could see investors waiting for a dip to re-enter into long positions.

Source: CME Group