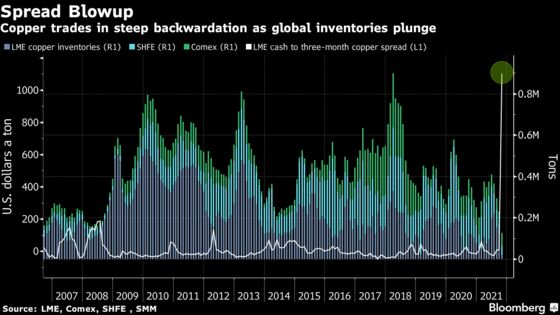

The copper market is so tight that spot contracts traded at the biggest premium over futures in at least 27 years in London.

The spread between cash and three-month futures surged to over $1,000 a ton on the London Metal Exchange on Monday, a premium not seen since at least 1994. The spread has been widening since early October as demand outpaced supply amid dwindling global exchange inventories.

Freely available inventories have shrunk by more than 90% over the past two months in LME-monitored warehouse after a surge in orders. And with stockpiles also declining quickly in China and the U.S., physical traders are firmly bullish on the fundamental outlook for the metal, even as macroeconomic headwinds loom.

The copper market is seen as a bellwether for economic growth because of the metal’s central role in construction, wiring and electronic goods. Dwindling global supplies and a widening price gap between cash prices and contracts for future delivery signal that buyers are accelerating efforts to lock in supplies.

“The LME notes recent price activity in the copper market,” te exchange said in an email to Bloomberg. “We will continue to closely monitor the situation, and have further options available to ensure continued market orderliness if these are required.”

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro rose 0.2% to $1.1635

- The British pound rose 0.5% to $1.3792

- The Japanese yen was little changed at 114.34 per dollar

Bonds

- The yield on 10-year Treasuries advanced four basis points to 1.64%

- Germany’s 10-year yield advanced four basis points to -0.11%

- Britain’s 10-year yield advanced three basis points to 1.17%

Commodities

- West Texas Intermediate crude rose 0.5% to $82.84 a barrel

- Gold futures rose 0.2% to $1,770.10 an ounce