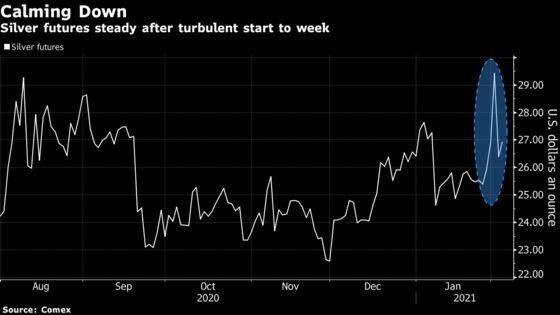

Silver gained after the biggest loss since August, with markets calming following the buying frenzy that sent prices to an eight-year high earlier this week.

Futures rose as much as 3.2% following a turbulent two days that saw the market whipsawed as a buying frenzy hit fever pitch, then sharply dropped off. Prices tumbled 10% on Tuesday as CME Group raised margin requirements.

Silver has been in the spotlight after posts on the Wall Street Bets forum called for a “short squeeze,” with prices pushing higher and options trading surging. But sentiment has now turned with users speculating supporting posts may be part of a pump-and-dump scheme — or that hedge funds infiltrated the board. Tuesday’s slump in silver came alongside a plunge in shares of GameStop Corp. and AMC Entertainment Holdings Inc., two popular trades with the Reddit crowd.

Reddit traders “have very little financial firepower, and while it’s a good story, the reality is that they simply do not have the capital to really push global markets like silver around,” said Michael McCarthy, chief market strategist at CMC Markets.

“I suspect what happened was, some bigger players got involved and tried to ride the Reddit wave, and that would explain why we saw that spectacular gain for silver. Given the lack of firepower for the Reddit traders, silver is returning to where it all began,” he said.

Silver futures were 3.2% higher at $27.25 an ounce by 10:32 a.m. in Singapore. Spot prices added 1.8%. BlackRock Inc.’s iShares Silver Trust, the short-squeeze target of retail traders last week, slumped more than 8% on Tuesday.

Goldman Sachs Group Inc. said silverremains the bank’s preferred precious metal, although it noted that Monday’s rally was never going to be enough to squeeze shorts as those positions are backed by physical stock.

There’s still a lot of interest. The U.S. Mint said it is still rationing sales of silvercoins because of “continued exceptional market demand,” as well as limited supplies and manufacturing capacity. In Australia, the Perth Mint has also seen high demand, with some clients liquidating gold positions to buy into silver, according to chief executive officer Richard Hayes.

“We still see demand and retail buying of physical when silver prices plummeted last night, though it has been subdued as compared to the last few days,” said Brian Lan, managing director of Singapore-based dealer GoldSilver Central Pte. “Silver prices are lower today as compared to the last few days, hence we expect to see some retail clients buying throughout the day.”