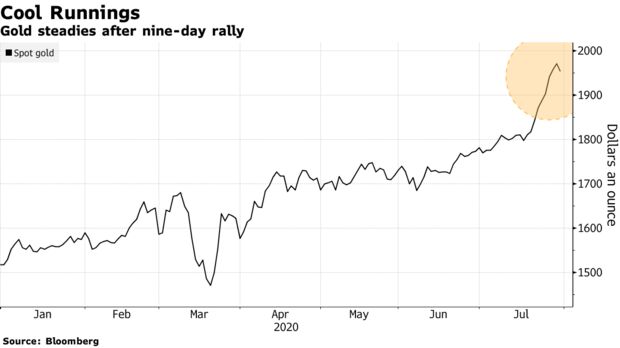

Gold retreated after a nine-day rally that included a record high as positive results from a vaccine study curbed demand for the metal as a haven, spurring investors to cash in recent gains.

Gold spot prices headed for the biggest decline in almost two months after news that an experimental coronavirus vaccine protected a group of macaque monkeys in an early study. The metal was also pressured as stocks pared losses, with gains in big technology companies ahead of earnings tempering concern over a slow economic rebound.

Read More : Gold Consumption Fell 56% From a Year Earlier to 165.6 Tons – GSR

“Whilst we believe there is further upside to the market, there are a number of risks which could stand in the way of this,” Warren Patterson, head of commodities strategy at ING Groep NV, said in an emailed note. “A swift rolling out of a Covid-19 vaccine, which sees economies around the world reopening at a quicker pace, and returning to a form of normality, would likely provide a boost to risk assets, and as a result, weigh on havens, such as gold.”

Spot gold fell 0.9% to $1,952.97 an ounce at 3:08 p.m. in New York. A close at that price would mark the biggest drop since June 5. The metal rose to an all-time high of $1,981.27 earlier in the week. Gold futures for December delivery fell 0.5% to settle at $1,966.80 an ounce on the Comex. Silver, platinum and palladium also declined.

Spot bullion has soared about 29% this year, supported by a confluence of factors from haven demand and a weakening dollar to negative real yields and a flood of monetary and fiscal stimulus. Another round of talks between the Trump administration and congressional Democrats Wednesday brought them no closer to a compromise on a virus-relief plan, as enhanced unemployment insurance for millions of out-of-work Americans runs out.

Even with the likelihood of higher price volatility in the near term, investment demand should hold up over a longer time period, the World Gold Council said Thursday.

“Gold is now in a consolidation phase,” Carlo Alberto De Casa, chief analyst at Activ Trades, said in an emailed note. “But the quick rebound when the price collapsed to $1,900 two days ago confirms that investors’ appetite for bullion is still significant and the main trend remains bullish, despite some traders taking profit after the massive rally of the last few weeks.”

Source : Bloomberg

Inflows into gold ETFs accelerated in Q2, taking H1 inflows to a record-breaking 734t. First half inflows surpassed the 2009 annual record of 646t and lifted global holdings to 3,621t.

The US dollar gold price gained 17% in H1, following a 10% increase during Q2. The gold price reached record highs in numerous currencies, including euros, sterling, rupee and renminbi among others.

Investment in gold bars and coins slowed sharply in H1 2020, down by 17% to 396.7t – an eleven year low. Steep declines in demand across Asia outstripped growth in the West as investors’ reactions to the pandemic diverged across the globe.

H1 jewellery demand almost halved to 572t amid the global disruption caused by COVID-19. The impact of the pandemic was unsparing and Q2 demand fell to an unprecedented 251t.

Central banks bought 233t of gold during H1, 39% below 2019’s record level. Buying has become more concentrated, with fewer banks adding to reserves so far in 2020.