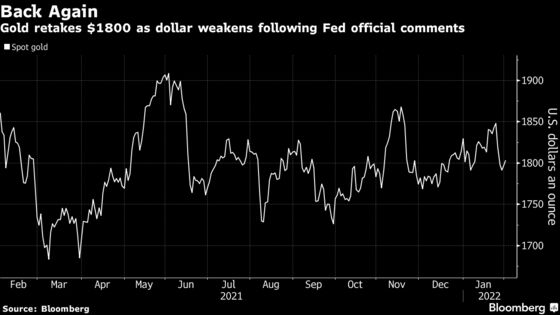

Gold Prices Hold Above $1,804: Gold Price advanced and the dollar pushed lower after a report showed companies in the U.S. unexpectedly shed jobs last month.

Businesses’ payrolls fell lastmonth by the most since April 2020, according to ADP Research Institute data released Wednesday. Meanwhile, Euroarea inflation unexpectedly accelerated to a record, overshooting expectations by the most in at leasttwo decades.

The euro zone inflation figures “could give gold something of a boost if the euro were to appreciate further in response and the U.S. dollar were tocontinue depreciating,” said Daniel Briesemann, an analyst at Commerzbank AG.

Gold also got help as concerns eased over the outlook for an aggressive stance on interest rates by the Federal Reserve. None of the six Fed officials speaking so far thisweek have backed the idea of a half-point rateincrease in March, and the most aggressive, James Bullard, president of the St. Louis Fed, said five hikes is “not too bad a bet.”

Spot gold rose 0.4% to $1,808.03 an ounce as of 3:13 p.m. in New York. Bullion for April delivery gained 0.5% to settle at $1,810.30 on the Comex. Silver, platinum and palladium also gained. The Bloomberg Dollar Spot index fell 0.2%, on course for its third consecutive decline.

Markets in China and some other Asian countries will be closed for much of the week for the Lunar New Year holidays.

Source: Bloomberg

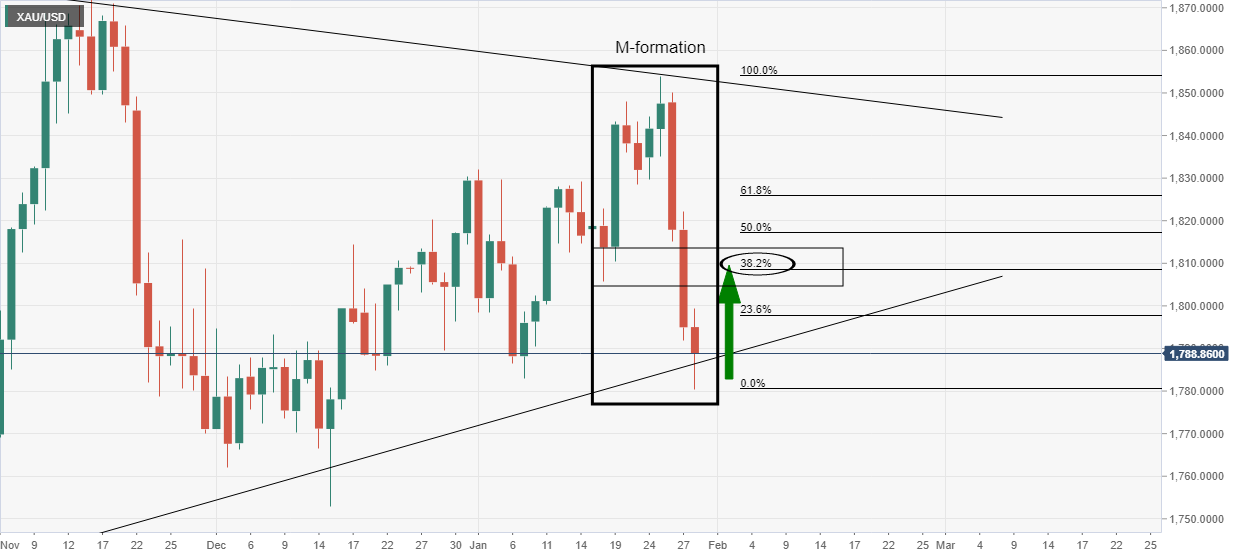

It was stated that ”considering the trendline support and the daily M-formation, the technicians would argue that a significant correction of the bearish impulse could be in play…”

Gold, daily chart prior analysis

In the case above, the 38.2% Fibonacci retracement level near $1,810 was the initial target area that had a confluence with prior structure as illustrated.

| Follow us on |

| Telegram, Facebook, Twitter, Linkedin, Instagram, YouTube, Tumblr, Pinterest, Reddit and Feedburner. |