Gold Silver Reports (GSR) – The London Metal Exchange (LME) is the futures exchange with the world’s largest market in options and futures contracts on base and other metals. As the LME offers contracts with daily expiry dates of up to three months from trade date, weekly contracts to six months, and monthly contracts up to 123 months, it also allows for cash trading. It offers hedging, worldwide reference pricing, and the option of physical delivery to settle contracts. Since 2012 it has been owned by Hong Kong Exchanges and Clearing, after LME’s shareholders voted in July 2012 to approve the sale of the exchange for a price of £1.4 billion.

mcx copper tips

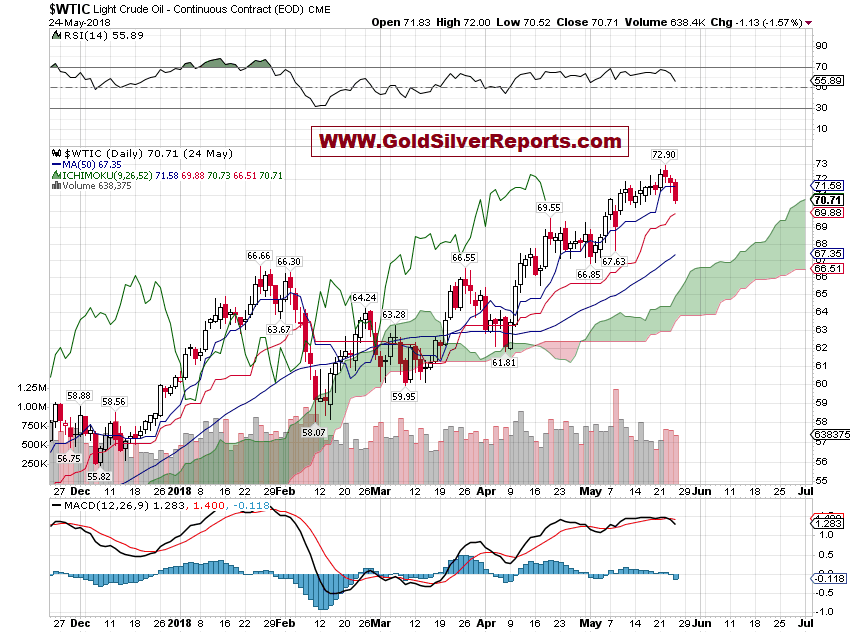

Crude MCX Tips Watch 4680 NYMEX Watch 68.25 Below Big Panic, Very Very Soon Tips By Neal Bhai MFA Technical Analyst

MCX CRUDE BELOW 4680, If Close Sell Any Rise or Sell Karo Aur So Jaao Stop Loss 4747 Target 4500——4400 Crude MCX Watch 4680 NYMEX Watch 68.25 Below Big Panic Very Very Soon Tips By Neal Bhai Neal Bhai Reports (NBR) By CFA’s and MFA’s Technical Team INDIA Mobile No. …

Zinc Slides to Nine-Month Low on LME; Teck signs Annual Zinc Concentrate supply Deals; Nyrstar Earnings Drop 5% in First Quarter

Gold Silver Reports (GSR) – Zinc Slides to Nine-Month Low on LME; Teck signs Annual Zinc Concentrate supply Deals; Nyrstar Earnings Drop 5% in First Quarter — Base metals prices on the London Metal Exchange were mostly lower at the close of trading on Thursday May 3, with zinc diving to its lowest point since August 2017. Read more in our live futures report.

Zinc Prices Under Pressure; HKEX appoints Cha as Chairman; Vale’s Base Metals earnings grow 45.7% in Q1

Gold Silver Reports (GSR) – Hong Kong Exchanges and Clearing has appointed local businesswoman and politician Laura Cha as its new chairman of the board, the exchange announced on Thursday. Vale’s base metals business posted a 45.7% increase in its core earnings in the first quarter of 2018 from a year earlier, helped primarily by the higher realized nickel prices during the period, the Brazilian diversified miner said on Wednesday.

Braking News; Base Metals Drift Lower on LME; Novelis No Longer Purchasing Aluminium from Rusal; China to ban Category 7 Copper Scrap Imports by Year End

The latest Base Metals news and price moves to start the Asian day on Friday April 20.

Base metal prices on the London Metal Exchange were lower at the close of trading on Thursday April-19-2018 despite aluminium volumes reaching a recordHigh of 41,000 lots. Read more in our live futures report.

Base Metals Prices Broadly Down, Aluminium Runs into Profit-Taking; LIVE FUTURES REPORT

Gold Silver Reports (GSR) – Base Metals Prices Broadly Down, Aluminium Runs into Profit-Taking; LIVE FUTURES REPORT — The most-traded June aluminum contract on the SHFE traded at 14,850 yuan ($2,363) per tonne as of 11.30am Shanghai time, down by 70 yuan per tonne from Tuesday’s close.

MCX Zinc Strong Support @202—199 level

Gold Silver Reports (GSR) – MCX Zinc Strong Support @202—199 level — Zinc on MCX settled up 1.23% at 205.20 gained on short covering and tracking LME zinc which rose 0.5 percent to $3,131.50 a tonne as investors wagered the latest U.S.-led strike on Syria would not escalate into a wider conflict, though Asian equities turned mixed as selling in bank shares slugged Chinese indexes.

Why U.S. Sanctions On Rusal Will Benefit Indian Aluminium Producers

Gold Silver Reports (GSR) – Why U.S. Sanctions On Rusal Will Benefit Indian Aluminium Producers — Integrated domestic aluminium producers — with presence from raw materials to the final product — like Hindalco Ltd. and National Aluminium Company Ltd. stand to gain more than Vedanta Ltd., said Goutam Chakraborty, analyst-institutional research at brokerage Emkay Global Financial Services.

What to Watch in Commodities: Aluminum, Trump Vs Xi, Copper, Soy

Gold Silver Reports (GSR) – What to Watch in Commodities: Aluminum, Trump Vs Xi, Copper, Soy — On top of that, there are two gatherings that’ll shape the big-picture agenda. In Asia, China’s leadership, including President Xi Jinping, will deliver their take from the Boao Forum for Asia. And in Peru, heads of state from across the Americas will gather in Lima for a summit that may provide a backdrop for a breakthrough on fraught Nafta talks between the U.S., Mexico and Canada.