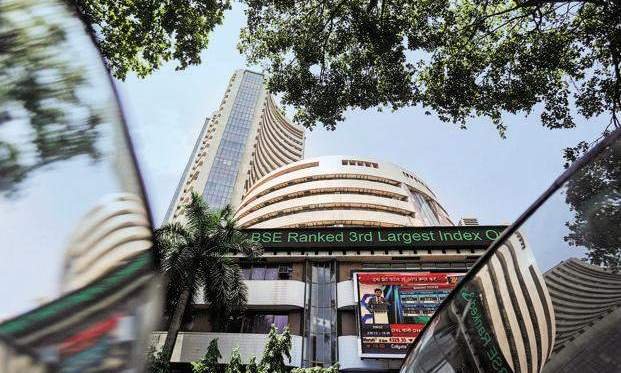

Indian stock markets returned to their winning ways on Tuesday, snapping their 6-day-losing run. The BSE Sensex today gained 584.81 points, or 0.72 per cent, to end at 81,634.8 levels. The Nifty50, too, shut shop at 25,013.15, up 217.38 points or 0.88 per cent as investors digested the Assembly elections results, and dazzling rally in China stocks moderated.

Reserve Bank of India’s (RBI’s) Monetary Policy

Investors were also waiting for the Reserve Bank of India’s (RBI’s) monetary policy decision on Wednesday.

Among individual stocks, Adani Ports, M&M, Reliance Industries, HDFC Bank, L&T, SBI, Ultratech Cement, NTPC, and Kotak Bank were the top Sensex gainers today, up between 1 per cent and 4.5 per cent.

Tata Steel, Titan Company, Bajaj Finserv, JSW Steel, Bajaj Finance, Tata Motors, and ITC, on the other hands, were the top Sensex losers today, down up to 2.7 per cent.

- Gold prices fell to a one-week low in line with US Inflation data

- Spot Gold At its All-Time High. Know How to Trade Using RSI and Economic Data

- Israel-Iran war: Gold rate today trades flat as market awaits US Fed minutes

- Garuda Construction and Engineering IPO Day 1: GMP, subscription status, review, other details. Should you subscribe?

- Copper prices fall due to National Day holiday in China

In the broader markets, the BSE MidCap index rose 1.86 per cent, and the BSE SmallCap index 2.44 per cent. The broader indices outperformed the benchmark indices today.

Meanwhile, among sectors, all the indices, barring the Nifty Metal index, rallied in trade today. The Nifty Media index jumped over 3 per cent, the Nifty Auto 1.84 per cent, and the Nifty Pharma 1.5 per cent.

Shares of One97 Communications, parent company of payments aggregator Paytm, surged as much as 15% on Tuesday, marking its best single-day gain since February 8, 2023.

With this move, the stock has turned positive on a year-to-date basis, now trading with gains of 12% so far in 2024.

Paytm’s shares had declined to their all-time low of ₹310 after the Reserve Bank of India had imposed restrictions on its Payments Bank in February, triggering a sharp sell-off in the stock.

Paytm has snapped a three-day losing streak post today’s move.

Global Cues

Global stocks also began Tuesday on a cautious note while oil prices stayed elevated as the escalating conflict in the Middle East sapped risk appetite ahead of China’s highly anticipated reopening after a long holiday.

The benchmark 10-year US Treasury yield held above 4 per cent in early Asia trade, as a robust US labour market prompted traders to heavily scale back their expectations for Federal Reserve rate cuts.

Hezbollah on Monday fired rockets at Israel’s third-largest city, Haifa, and Israel looked poised to expand its offensive into Lebanon, one year after the devastating Hamas attack on Israel that sparked the Gaza war.

Heightened fears of a widespread conflict and disruptions to supply sent Brent crude futures surging above $80 a barrel for the first time in over a month in the previous session.