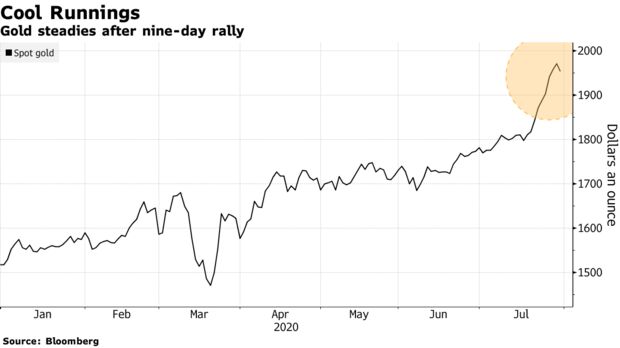

Gold retreated after a nine-day rally that included a record high as positive results from a vaccine study curbed demand for the metal as a haven, spurring investors to cash in recent gains.

- Spot Silver Mega Update Till Feb 28, 2026: Buy or Sell? Latest Levels & Strategy

- MCX Share Price Falls 80% Today: Real Crash or Technical Adjustment?

- Sensex Today Jumps 500+ Points, Nifty Above 26,300 as Bank Nifty Hits Record High

- Stock Market Today: Sensex Slips 32 Points, Nifty Ends Flat on First Day of 2026

- MCX & NCDEX on January 1, 2026: Are Commodity Markets Open or Closed?

Gold spot prices headed for the biggest decline in almost two months after news that an experimental coronavirus vaccine protected a group of macaque monkeys in an early study. The metal was also pressured as stocks pared losses, with gains in big technology companies ahead of earnings tempering concern over a slow economic rebound.

Read More : Gold Consumption Fell 56% From a Year Earlier to 165.6 Tons – GSR

“Whilst we believe there is further upside to the market, there are a number of risks which could stand in the way of this,” Warren Patterson, head of commodities strategy at ING Groep NV, said in an emailed note. “A swift rolling out of a Covid-19 vaccine, which sees economies around the world reopening at a quicker pace, and returning to a form of normality, would likely provide a boost to risk assets, and as a result, weigh on havens, such as gold.”

Spot gold fell 0.9% to $1,952.97 an ounce at 3:08 p.m. in New York. A close at that price would mark the biggest drop since June 5. The metal rose to an all-time high of $1,981.27 earlier in the week. Gold futures for December delivery fell 0.5% to settle at $1,966.80 an ounce on the Comex. Silver, platinum and palladium also declined.

Spot bullion has soared about 29% this year, supported by a confluence of factors from haven demand and a weakening dollar to negative real yields and a flood of monetary and fiscal stimulus. Another round of talks between the Trump administration and congressional Democrats Wednesday brought them no closer to a compromise on a virus-relief plan, as enhanced unemployment insurance for millions of out-of-work Americans runs out.

Even with the likelihood of higher price volatility in the near term, investment demand should hold up over a longer time period, the World Gold Council said Thursday.

“Gold is now in a consolidation phase,” Carlo Alberto De Casa, chief analyst at Activ Trades, said in an emailed note. “But the quick rebound when the price collapsed to $1,900 two days ago confirms that investors’ appetite for bullion is still significant and the main trend remains bullish, despite some traders taking profit after the massive rally of the last few weeks.”

Source : Bloomberg

Disclaimer

This article is intended for educational purposes only. The views and opinions expressed are those of individual analysts or brokerage firms and do not represent the views of GoldSilverReports.com. Investors are strongly advised to consult certified financial experts before making any investment or trading decisions.

| Follow us on |

| Telegram, Whatsapp , Facebook, Twitter, Instagram, YouTube, Google Business Profile and Truth Social. |