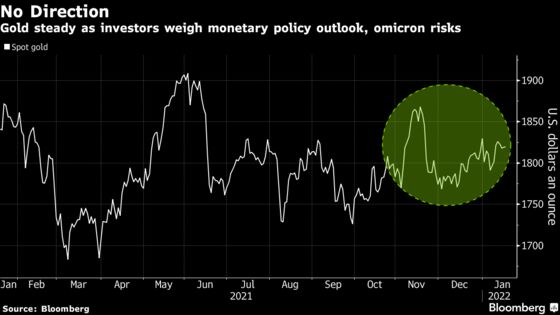

Gold was steady as investors weighed the outlook for monetary policy against the risks posed by the omicron virus variant to the global economic recovery.

Yields on 10-year Treasuries hit the highest level since January 2020 amid increasing bets that the Federal Reserve will raise interest rates in March, with officials saying they may need to implement hikes faster than expected to curb the hottest inflation since the 1980s.

Meanwhile, the Bank of Japan kept its negative interest rate, bond yield target and asset purchases unchanged at the end of its meeting Tuesday, a widely forecast decision given an overall inflation pulse that remains far weaker than in the U.S. and other major economies.

Still, with energy costs surging, the bank nudged up its forecasts for prices in the year starting in April and the following year, and changed its view of the inflation risks they face. Brent oil extended gains to the highest level in seven years as geopolitical tensions stirred in the Middle East, adding to global inflation concerns.

On the virus front, President Joe Biden’s chief medical adviser on the pandemic Anthony Fauci said it’s too soon to know whether the rapid spread of the new variant will hasten the end of the health crisis.

Gold is holding above $1,800 an ounce after dropping for the first time in three years in 2021 amid the prospects of monetary policy tightening and the deployment of vaccines. Still, bullion’s traditional role as an inflation hedge and the uncertainty over omicron’s impact is supporting demand for the haven asset.

“Gold prices are supported by a weakening U.S. dollar, but rising Treasury yields may limit the upside,” said Margaret Yang. “Recent corporate earnings highlighted risks of rising labor costs, underscoring wage inflation that may spur quicker Fed rate hikes down the road. Meanwhile, crude oil prices are trading at multi-year highs as demand picks up, putting further pressure on policymakers to rein in inflation.”

“Against this backdrop, yields may continue to march higher and weigh on gold prices,” said Yang. “I see resistance at $1,834 and support at around 1,809 in the near term.”

Spot gold slipped 0.1% to $1,816.93 an ounce by 12:15 p.m. in Singapore, after rising 0.1% Monday. The Bloomberg Dollar Spot Index climbed 0.1%. Silver and platinum dropped, while palladium advanced.

Source: Bloomberg

सोशल मीडिया अपडेट्स के लिए हमें

Facebook ( https://www.facebook.com/goldsilverreports/ )

linkedin (https://www.linkedin.com/in/nealbhai/ )

और Twitter ( https://twitter.com/goldsilverrepor ) पर फॉलो करें।

हमारी फ्री सर्विस और लोगो की paid सर्विस से कई गुना अच्छी है।

आपको हर दिन दिए जाएंगे 3 से 5 कॉल बिलकुल फ्री

हर CALL में PROFIT दिये जायेंगे

तो जल्दी से MCX CHANNEL को JOIN कर लो (NEAL BHAI REPORTS)

JOIN US CLICK HERE

EQUITY CHANNEL को JOIN कर लो (EQUITY FREE TIPS)

JOIN US CLICK HERE