Crude Oil Price Target Would Make a Far Better Goal, If you can’t hit the target, bring it closer. That seems to be the policy adopted by the OPEC+ alliance of oil producers as they make the world’s biggest-ever output cuts in an attempt to shore up oil prices.

- Vodafone Idea Crashes 9% as Supreme Court Deals Fresh AGR Blow – October Hearing Spells Doom

- Copper Prices Shines Bright: The Red Metal Turning into the New Gold for Investors

- Gold Prices Hold Strong Above ₹1.12 Lakh/10g: Profit-Booking Ahead or More Upside?

- Tax Audit Report Deadline Extended to Oct 31, 2025: Rajasthan & Karnataka HC Orders

- Precious Metals Break Records: Gold & Silver Prices Skyrocket on Fed Buzz

Crude Oil Price Target Would Make a Far Better Goal

After a meeting in January, the group’s co-leader, Saudi Arabia’s oil minister, Prince Abdulaziz Bin Salman, announced that the producers were setting themselves a new target for their output cuts — restoring oil stockpiles in the developed countries of the Organisation for Economic Cooperation and Development to a new five-year average level.

They’re focusing on the OECD because its members report oil stockpiles in a (relatively) timely fashion — preliminary levels for the end of December were published by the International Energy Agency last week, although they will be revised for many months to come. Whereas other countries, like China, don’t publish oil stockpile levels at all.

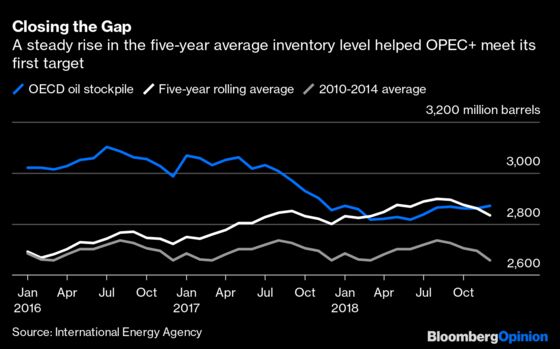

OPEC+ was formed in 2016 to combat the soaring global oil stockpile that resulted from the second U.S. shale boom and the collapse in oil prices. Its members sought to bring the volume of oil stored in tanks, salt caverns, ships and pipelines down to its five-year average level, although they were never quite specific about which five-year measure they had in mind. It was meant to be a quick, six-month process starting in January 2017. More than four years on, their efforts are continuing, given new urgency by the Covid-19 pandemic.

One target the group appeared at first to adopt was the five-year rolling average stock level. The problem is that measure keeps changing as each new month replaces its counterpart of five years earlier.

During the first years of the deal, that created target inflation, with stock levels in the newly-added months much higher than the ones they were replacing. Over time, the very excess stockpiles they were trying to drain boosted the five-year average by 210 million barrels, or 7%. That in turn narrowed the stockpile excess by 40%, with the actual drawdown of oil from inventories accounting for only 60% of the rebalancing.

Another target that seemed appealing was the average inventory level over the 2010-2014 period. This had the advantages of providing a fixed goal and excluding the period of excess stocks. The alliance never got close to that target, while stockpiles returned to their five-year moving average level in early 2018.

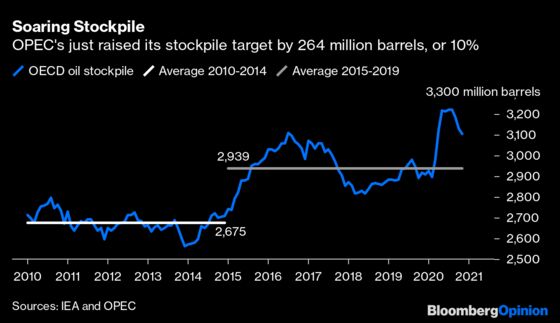

The producers have recognized that a constantly moving target undermines their effort to rebalance the market. They’ve also accepted that the 2010-2014 average is now, in the words of Prince Abdulaziz, “truly obsolete.”

So now they’ve decided to adopt the 2015-2019 average as their latest target. But that one, too, although fixed, has several shortcomings.

One of the main purposes of oil inventories is to provide a cushion to offset any unexpected disruptions to supply. Therefore it would be more sensible to measure them in terms of how many days’ worth of demand they represent, rather than in simple volume terms.

In practice that requires-forecasting demand, adding a further layer of uncertainty to a measurement already hampered by a lack of timely data. Add to that the exceptional volatility in demand over the past 12 months, plus the huge uncertainties going forward, and it’s easy to see why OPEC+ focuses on stockpiles in simple volume terms.

But a target based solely on the stockpiles that are reported misses the much larger volumes that are not. Satellites and drones can be used to estimate volumes of oil held on ships or in tanks with floating roofs to build a clearer global picture, but they can’t measure volumes held underground or in tanks with fixed roofs.

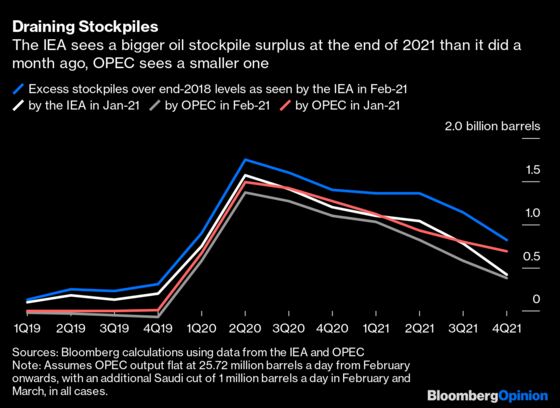

So we’re left using imbalances between supply and demand numbers to estimate changes in global stockpiles. Measuring oil demand is notoriously difficult, too, as the latest monthly reports from the IEA and OPEC, both published on Thursday, show. They each made significant revisions to their estimates for 2019, creating very conflicting signals.

With no corresponding revisions to supply, the IEA’s lower demand numbers imply that global stockpiles rose higher by the middle of 2020 than they had previously thought. OPEC’s upward revision to demand for the same period reduced the size of the excess stockpile its members and allies need to tackle.

The IEA’s changes delay the point at which global stockpiles will return to their end-2018 levels by nine months, pushing it back to the middle of 2023. OPEC’s revisions bring it forward to the third quarter of 2022. In stark contrast, the OPEC+ alliance’s monitoring committee said recently that it would be able to say “job done” as soon as this August, when, based on its own supply and demand forecasts, OECD stockpiles are expected to return to average 2015-2019 levels.

But don’t set off the fireworks just yet. Arguably, it is stockpiles in places like China and India, where demand has recovered much more quickly, that are really important. If those are coming down faster than the more visible OECD stockpiles, because of increased economic activity and cold weather, producers risk over-tightening the market without realizing it.

While pursuing a stockpile target sounds much better than chasing a price target, which inevitably opens the group up to charges of operating as a cartel, it has some huge drawbacks. The unwillingness of some countries to publish inventory levels and the difficulty of measuring oil demand in a timely manner make stock levels highly imprecise.

The producers might do better coming clean and adopting a crude oil price target. Then all they’d have to do is agree on what price suits them all!

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners. (Bloomberg)