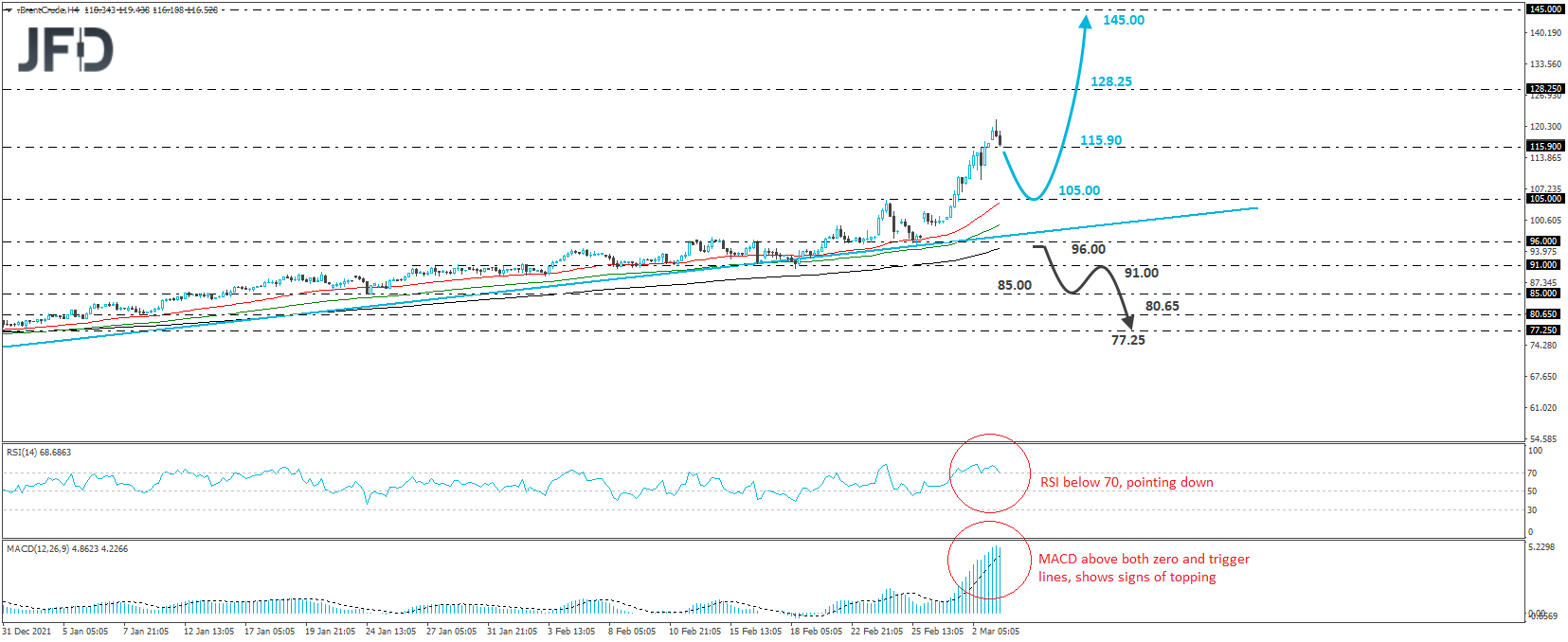

Brent Crude oil skyrocketed yesterday, hitting levels lastseen in February 2013. The advance broughtthe price temporarily above 120.00, and then wehad a small setback. Overall, the black liquid remains well above the upside support line drawn from the low of December 20th, and thus, we would consider the picture to be as bullish as it can get.

The current setback may continue for a while more, but the bulls may jump back into the action from near the 105.00 zone, marked by the inside swing high of February 24th, which is still above the aforementioned upside line. This could result in a strong rebound towards the 115.90 zone, marked by the high of June 2014, the break of which could allow extensions towards the peak of March 2012.

If the bulls are not willing to stop there either, then a break higher could take Brent into territories last tested in 2008, with the next potential resistance, perhaps being the psychological zone of 145.00, which is slightly below the peak of July 2008.

Shifting attention to our short-term oscillators, we see that the RSI turned down and just exited its above-70 zone, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. Both indicators suggest that the upside speed may ease for a while, thereby allowing a possible setback before the next leg north.

Nonetheless, in order to start examining the bearish case, we would like to see a clear dip below 96.00, a support marked by the low of February 25th. This could confirm the break below the upside line drawn from the low of December 20th, and could initially pave the way towards the 91.00 territory, which provided support between February 8th and 18th, and acted as a resistance between January 27th and February 2nd. That said, if the bears are not willing to stop there, then a break lower could see scope for extensions towards the 85.00 area, marked by the low of January 24th, where another break could open the path towards the low of January 10th, at 80.65, or even the low of January 3rd, at 77.25.

सोशल मीडिया अपडेट्स के लिए हमें

Facebook ( https://www.facebook.com/goldsilverreports/ )

linkedin (https://www.linkedin.com/in/nealbhai/ )

और Twitter ( https://twitter.com/goldsilverrepor ) पर फॉलो करें।

हमारी फ्री सर्विस और लोगो की paid सर्विस से कई गुना अच्छी है।

आपको हर दिन दिए जाएंगे 3 से 5 कॉल बिलकुल फ्री

हर CALL में PROFIT दिये जायेंगे

तो जल्दी से MCX CHANNEL को JOIN कर लो (NEAL BHAI REPORTS)

JOIN US CLICK HERE

EQUITY CHANNEL को JOIN कर लो (EQUITY FREE TIPS)

JOIN US CLICK HERE

Gold looks to $1,950 again ahead of Russia-Ukraine peace talks — Gold price extends its range play around the $1,930 level for the third consecutive day, reversing a part of Wednesday’s sell-off. Soaring oil prices, a fallout of the Russia-Ukraine crisis, have refueled stagflation concerns worldwide, reviving gold’s demand as a safe haven.