Gold Silver Reports – It’s not just politics that’s polarized right now. Gold investors are also split down the middle.

A survey of 38 market professionals shows a $700 divide between the most optimistic and most pessimistic forecasts for prices next year. That leaves the median estimate of $1,290 an ounce at the end of 2018 little changed from current levels.

Here’s what could go right or wrong for the bulls and bears:

As major stock indexes in the U.S., Europe and Asia are already at or close to record annual closes, and valuations stretched by historical standards, some expect a correction. That would benefit gold, according to Carsten Fritsch and his colleagues at Commerzbank AG. However, a continued rally, helped by interest rates that remain low relative to past decades, could sap demand for havens such as gold.

U.S. Elections

With investigations into alleged Russian interference in U.S. elections potentially coming to a head in coming months, mid-term voting in November will add to uncertainty over the outlook for Donald Trump’s administration, according to Adrian Day, president of Adrian Day Asset Management. Yet Trump has managed to weather previous storms thanks to support from his base and Republican lawmakers.

Bitcoin Bonanza

If 2017’s hottest asset comes crashing back to Earth, speculative money may be drawn back into gold, according to Walter Otstott, a senior broker at Dallas Commodity Co. in the Texas city. He sees gold peaking at $1,600 an ounce next year, compared with the price on Friday of about $1,297. With bitcoin trading up about 1,400 percent this year, tech libertarians and apocalypse survivalists who may have previously bought gold have been lured away by virtual currencies. If bitcoin resumes gains in January, gold could suffer.

North Korea

And talking of the apocalypse, Kim Jong-Un’s nuclear ambitions could yet see a revival for haven investments. Bullion dealer GoldCore Ltd.’s Mark O’Byrne predicts gold could end the year at $1,500 if geopolitics heats up in North Korea or the Middle East. On the other hand, Pyongyang’s missile tests this year have had little effect on the market as investors become inured to the regime’s war of words with President Trump.

Read More: Gold Retracing Mid-Term Zone – Gold Silver Reports

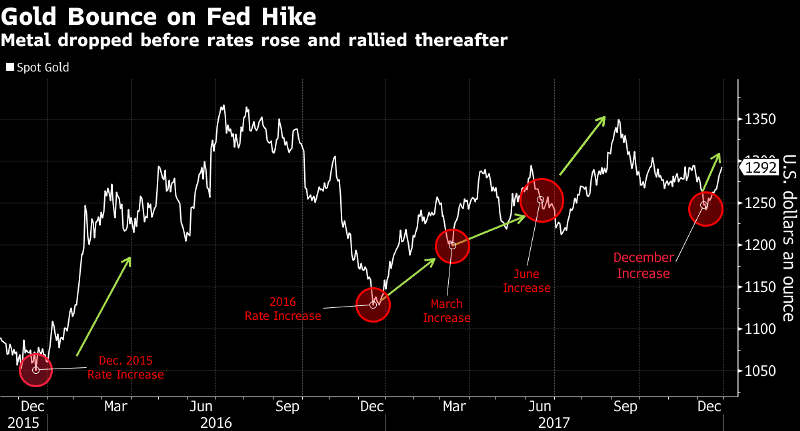

Real Rates

Inflation and rates, for many analysts, are the biggest factors influencing the gold price. The opportunity cost of holding the metal should increase when rates are high, while its inflation-busting qualities are attractive when policy is loose and the cost of goods is rising. Yet with the U.S. in a tightening cycle and Europe expected to follow, higher rates haven’t led to gold price declines, even with inflation moderate by historic standards. – Neal Bhai Reports